- Excellent 4.7 Trustpilot

Start an LLC: Step-by-Step Guide

Welcome to your ultimate guide to forming an LLC, tailored specifically for aspiring startup founders. If you're feeling overwhelmed by the intricacies of business structures, you're not alone. Let's demystify the process and help you understand why an LLC might be the perfect choice for your startup.

- Bootstrapped, Founder Led, Independently Owned Since 2004 With Over 1,000,000 Entrepreneurs Served!

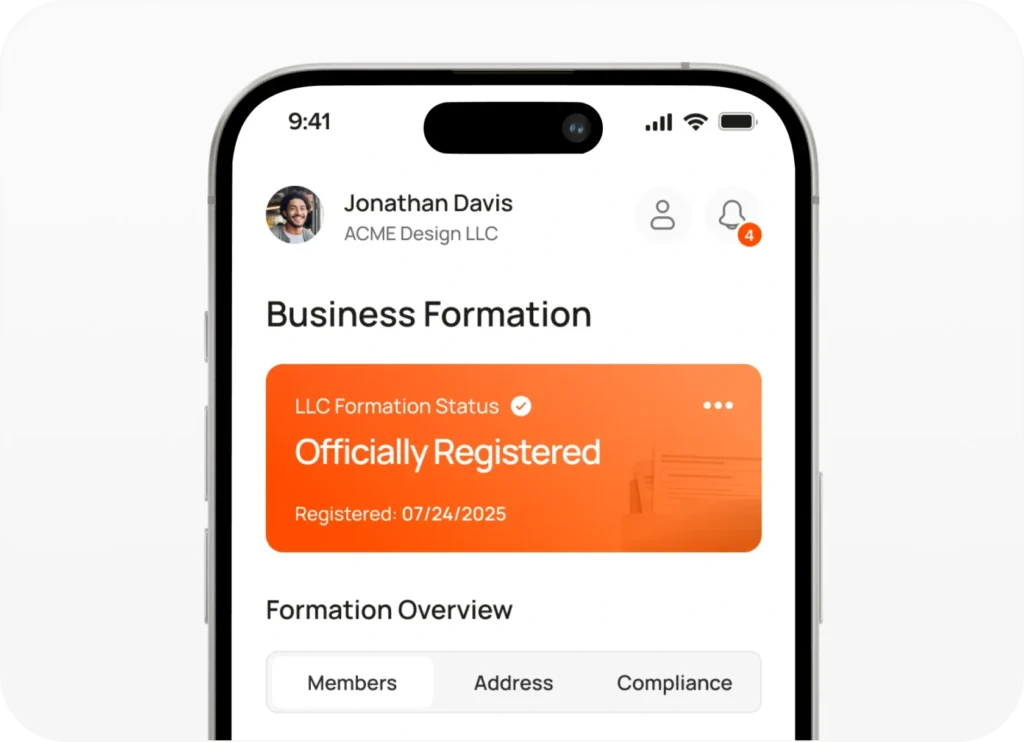

Launch Your LLC with Confidence

Starting your LLC is a crucial step in your entrepreneurial journey. With Sunbiz, you get the guidance, support, and resources needed to make the process seamless and stress-free.

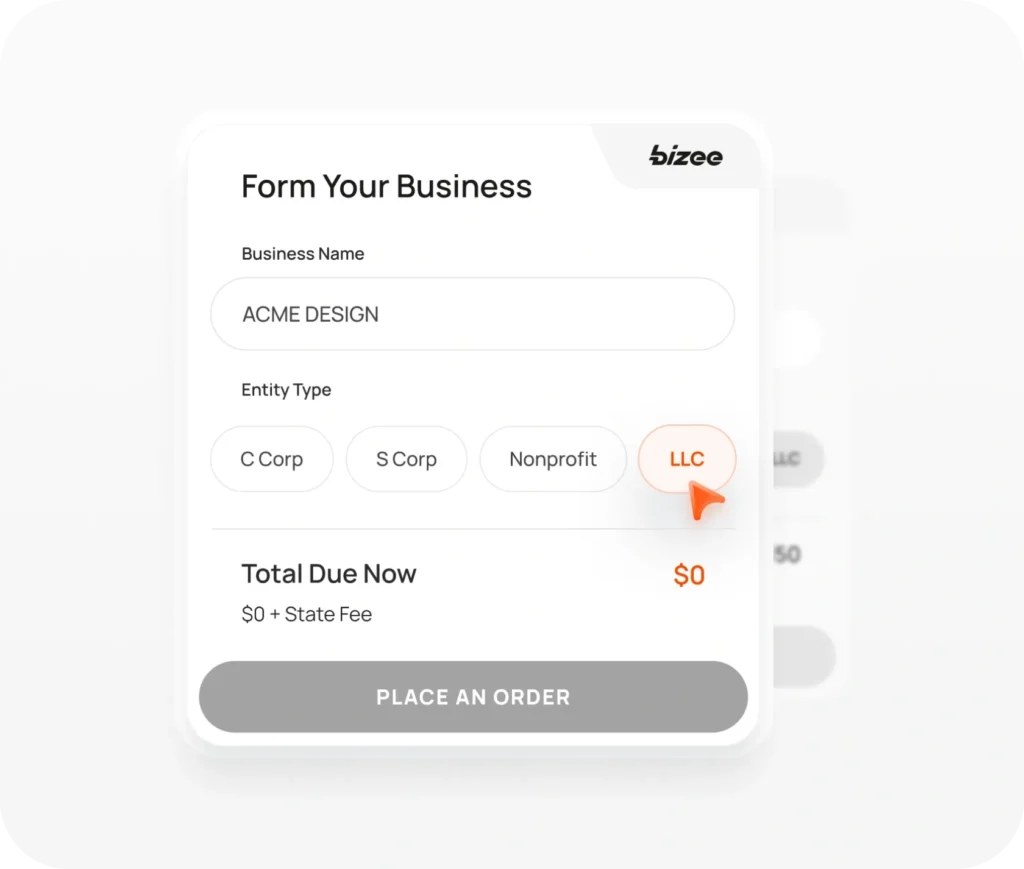

Pick the package that works best for your business formation period. Each package is eligible for one free year of Registered Agent service from Sunbiz.

- Basic

+ State Free

One-time payment

Our core features for the lowest price

- Standard

+ State Free

One-time payment

Comprehensive Feature to get your business started

- Premium

+ State Free

One-time payment

Full- service feature at the best value

Key Questions and Answers

A Comprehensive Guide for Startups

What Is an LLC?

An LLC, or Limited Liability Company, blends the best aspects of sole proprietorships and corporations. You get the straightforward taxation of a sole proprietorship but with the robust liability protection of a corporation. This means your personal assets—like your home and savings—are shielded from business debts and lawsuits. It’s like having the best of both worlds, without the usual headaches.

Is Starting an LLC Right for You?

Choosing the right business entity is crucial—it’s like laying the foundation for your future skyscraper. LLCs are particularly beneficial for startups because they offer simplicity and protection. If you’re a sole proprietor or have a small team, an LLC can provide the safety net you need while keeping things straightforward.

Consider this: businesses like real estate agencies, financial advisory firms, and even coffee shops thrive as LLCs. Why? Because the structure allows them to protect personal assets and avoid double taxation. However, not every business can or should form an LLC. Financial institutions like banks and insurance companies often face regulatory hurdles, and certain professionals in states like California (such as architects and healthcare providers) are restricted from forming LLCs.

Form My LLC

Entrepreneurship is booming, and we're proud to be one of America's fastest-growing companies. Here's how you can start your LLC in six straightforward steps:

1 Name Your LLC

Your business name is the first impression you make. It’s essential to pick a name that stands out and accurately represents your brand. In addition to selecting a unique name, you’ll need to include a designator like “LLC” or “Limited Company” to indicate your business structure.

Tips:

- Use our Business Name Search tool to check the availability in your state.

- Not settled on a business name yet, our Name Generator can help.

2 Provide an Address

Your LLC needs an official business address. This could be your home address if you’re running a home-based business, a rented office space, or even a virtual address. Remember to check your state’s regulations, as some states do not accept P.O. Box addresses.

Pro Tip:

A Virtual Address can provide privacy and the flexibility to manage your mail from anywhere. Check out our Virtual Address Service for a reliable solution.

3 Assign a Registered Agent

A Registered Agent receives official state correspondence on behalf of the company and must be physically available during business hours. While you can act as your own registered agent, we recommend using a professional service to avoid the hassle and maintain privacy.

Why Choose Us?

With any of our business formation packages, you get one year of Registered Agent Service for free. Let us handle the details so you can focus on growing your business.

4 Provide Names and Addresses of LLC Members

You’ll need to submit the names and addresses of all your LLC members to the state. This step is straightforward but crucial for maintaining transparency and compliance.

Note: You can use street addresses or P.O. boxes for your LLC members’ addresses, depending on your state’s requirements.

5 State the Purpose of Your LLC

When filing your LLC, you must state the purpose of your business. This can be a specific description or a broad statement like “any lawful purpose.” If you’re still refining your business idea, a general statement will suffice and gives you the flexibility to expand later.

Quick Tip:

Keeping it simple with “any lawful purpose” covers most business activities

and can save time during the filing process.

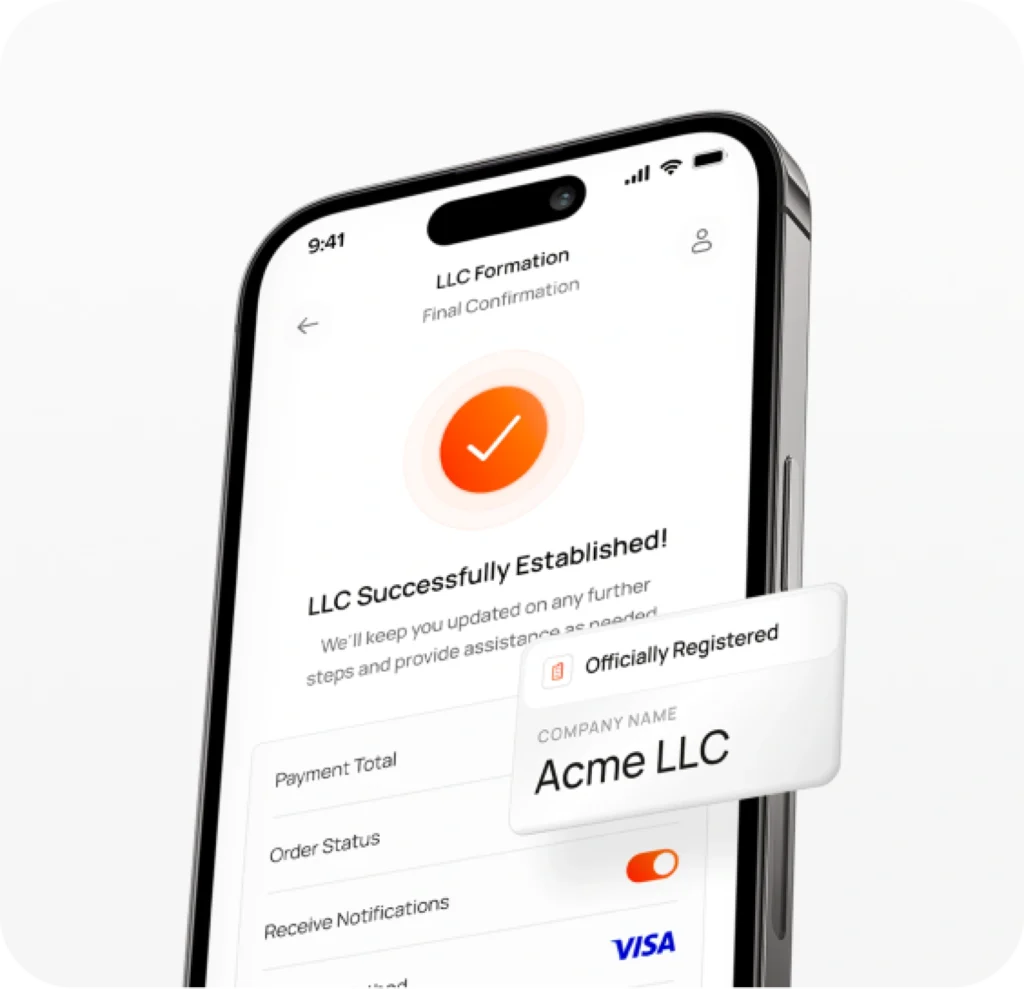

6 File the Articles of Organization

The final step is to file your Articles of Organization with the state and pay the associated fees. This document officially creates your LLC. Filing can be done online or by mail, depending on your state.

Quick Tip:

Bizee handles all the paperwork and filing for you, ensuring everything is done correctly and efficiently. Save time and reduce stress by letting us take care of this crucial step.

Types of LLCs

Understanding the different types of LLCs can help you choose the right one for your startup.

Single-Member LLC

Perfect for solo entrepreneurs. This type of LLC has only one owner, or member, but provides the same benefits of liability protection and pass-through taxation as a multi-member LLC. Single-member LLCs who elect to be taxed as sole proprietors are also known as disregarded entities.

Multiple-Member LLC

Ideal for startups with multiple founders. This structure allows for shared ownership, with profits and losses divided among members. It offers even stronger liability protection than limited partnerships while maintaining operational flexibility.

Manager-Managed LLC

The most common type of LLC, member-managed LLCs allow all owners to actively run the business. Decisions are made collectively, making this a popular choice for small businesses where owners are hands-on.

Series LLC

Suitable for businesses where some members prefer to remain passive. This type of LLC designates specific managers to handle the day-to-day operations, which can be a single person or a group, freeing other members from active management duties and self-employment taxes. Some states also allow the members to stay anonymous.

Professional LLC

Professional Limited Liability Companies are reserved for owners who intend to offer services with professional licensing requirements. About half of U.S. states use PLLCs and the other half do not. In addition to professional licenses with their own governing bodies, the state’s licensing department can help you determine if you need a license and/or a PLLC business structure.

Family LLC

This is an informal label for LLCs formed to facilitate estate planning. Essentially, it uses the LLC business structure to minimize gift and inheritance taxes. Nevada is one example of a state that does offer a formal business structure–known as a Restricted LLC–that’s commonly used for estate planning.

L3C (Low-Profit Limited Liability Company)

Blending the flexibility of an LLC with a social mission, an L3C is a for-profit entity with a stated charitable or educational goal. Currently available in 10 states, this structure is ideal for businesses aiming to achieve both financial and social objectives, providing a structure that appeals to social entrepreneurs and impact investors.

Benefits of an LLC

Every savvy entrepreneur knows that weighing the pros and cons is essential. Let’s dive into why an LLC could be your startup’s best friend.

Pros

Limited Liability Protection

Even more than limited liability partnerships, LLCs offer some of the strongest available protections for your members’ personal assets.

Pass-Through Taxation

Simplify taxes by merging your business income with your personal income.

Flexible Management

Operate your business how you see fit, whether as a member-managed or manager-managed LLC.

No Ownership Restrictions

Partner with anyone, including foreign nationals. Add as many members to the LLC as you need.

Minimal Compliance

Enjoy fewer regulations compared to corporations. Many LLCs simply need a registered agent and to file an annual report.

Versatile Tax Status

Opt to be taxed as a sole proprietor/partnership or as an S Corp to benefit your business.

Pros

Franchise Taxes

Some states impose income-based or flat-fee taxes on all businesses other than sole proprietors.

Strict Record-Keeping

Maintaining clear separation between personal and business finances will increase your bookkeeping needs.

Investor Restrictions

While LLCs allow for an unlimited number of members, there are some restrictions on the allowable types of investments.

Lacks Partnership Structure

Some professionals like lawyers and accountants prefer the rigid, collaborative nature of limited partnerships.

What to Expect from Bizee Services and Support

Join over 1,000,000 entrepreneurs who have chosen us to streamline their business formation process.

"Sunbiz Fillings made starting my agency incredibly easy. I was up and running with an LLC and EIN in less than 48 hours. Best decision for my business."

Marcus Holloway

Founder, Holloway Media

Support

These reviews are only a snapshot of the 20,000+ positive reviews we’ve received just on Trustpilot.

We offer the best customer support in the industry, earned from decades of experience. Most of the time, starting an LLC is a straightforward process, but we’ve seen it all—from simple typos to truly unique situations that even state governments didn’t anticipate.

- Formation And Compliance