- Excellent 4.7 Trustpilot

How to Dissolve an LLC

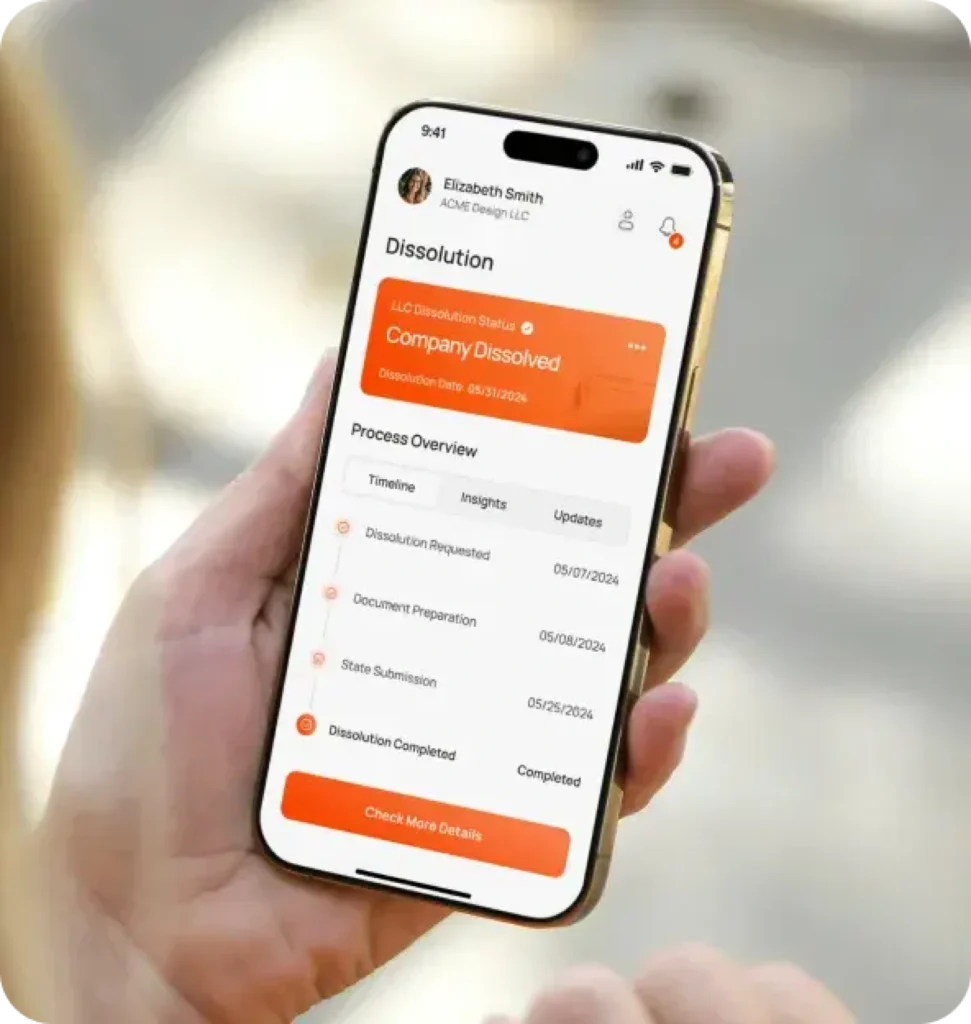

Over the course of business operations, there occasionally comes a time when you need to consider closing your LLC. However, many entrepreneurs are unfamiliar with the process. This guide provides comprehensive information on how to dissolve an LLC, including the necessary steps, costs involved, and legal requirements. By following the proper procedures, you can ensure a smooth and compliant dissolution process.

Bootstrapped, Founder Led, Independently Owned Since 2004 with Over 1,000,000 Entrepreneurs Served!

Sunbiz Startup Central

The media center. Guts, grit, and a game plan for launching your business.

Introduction to Dissolving an LLC

Hold a meeting with the Board of Directors

You can avoid future liabilities and ensure compliance with state laws by properly dissolving your LLC.

Settle Financial Obligations

If you’re ready to close your company, it is important to understand how to dissolve an LLC correctly to avoid legal complications and financial issues down the road.

Dissolve the Company and Then Cancel Permits

The dissolution process includes first reaching an internal company agreement to pursue dissolution, filing your Articles of Dissolution with the state, and settling all financial obligations and accounting.

We’ll look at these steps in more detail, but first, let’s address the difference between dissolving and terminating an LLC.

Dissolving vs Terminating an LLC

What is the difference between these two actions?

Dissolution

Dissolution is the process of formally closing the LLC, which includes winding up its affairs, settling debts, and distributing remaining assets. This step ensures you meet all legal and financial obligations before ending the entity’s existence.

Termination

Terminating the company is the final step after dissolution, where the LLC ceases to exist as a legal entity. Termination means the state removes the LLC from its registry and no longer recognizes it as a business.

Both dissolution and LLC termination are necessary to end the company’s existence and obligations completely. Members could remain liable for the LLC’s obligations without proper dissolution and termination.

Dissolving an LLC involves several key steps.

How to Dissolve an LLC

1. Internal Agreement and Decision-Making

Member voting

Ensuring all members agree to dissolve the LLC often requires a formal vote, as outlined in your LLC’s operating agreement. Unanimous consent might be necessary, depending on your agreement.

Operating agreement provisions

Follow any procedures outlined in your LLC’s operating agreement. This document should specify the process for dissolving the LLC, including how to conduct and document votes.

Document the decision

Record the decision to dissolve in meeting minutes or a written resolution. This documentation is crucial for legal compliance and future reference.

2. Filing the Articles of Dissolution

Prepare the document

Complete the necessary forms, often called Articles of Dissolution or Certificates of Dissolution. Typically, these forms are available on the Secretary of State’s website where you registered your LLC.

Submit the document to the state

File the articles with the state where the LLC is registered. Submission can usually be done online, by mail, or in person.

Typical fees

Filing fees vary by state, typically ranging from $20 to $200. It’s important to check your specific state’s requirements and fee schedule.

3. Winding Up the LLC

Settling debts and obligations

Pay off any outstanding debts and liabilities. This includes loans, vendor bills, and any other financial obligations.

Distributing remaining assets

Distribute any remaining assets to the LLC members according to their ownership interests. The distribution should follow the terms outlined in the operating agreement.

Final accounting

Prepare a final statement of accounts and tax filings. Such preparation ensures all financial affairs are settled, and there are no lingering obligations.

Table of Contents

Do I Need to Notify the IRS If I Close My Business?

Yes, you must inform the IRS about the dissolution by filing the final tax returns and checking the box indicating that it is the final return. This step ensures that the IRS knows the business is no longer operating. Submit the final income tax return for the LLC and any employment tax returns if you had employees. This includes Forms 1065, 1120, or 1120S, depending on your LLC’s tax classification. Your EIN will remain assigned to your business even after it closes; however, the IRS will mark it as closed. This ensures that the EIN cannot be used for future business activities.

How Much Does It Cost to Dissolve an LLC?

The cost to dissolve an LLC varies.

- Filing fees. State filing fees for the Articles of Dissolution typically range from $20 to $200. The exact amount depends on the state where you registered your LLC.

- Additional costs. You may need professional assistance to ensure all steps are completed correctly. If so, you could incur additional costs such as legal fees, accounting fees, and costs associated with settling debts and distributing assets.

Each state has different requirements and fees for dissolving an LLC. It’s important to research your specific state’s process and fees to budget appropriately.

Additional Considerations for LLC Dissolution

Several other factors need to be considered when closing an LLC.

Canceling Licenses and Permits

Be sure to cancel all business licenses and permits to avoid future liabilities. This includes state and local business licenses, sales tax permits, and any industry-specific licenses.

Notifying Creditors and Stakeholders

Inform creditors, customers, and other stakeholders about the dissolution. Providing advance notice helps maintain good relationships and ensures a smooth winding-up process.

Record-Keeping Requirements

Maintain records of the dissolution process for future reference, including final tax returns and accounting documents. It’s recommended to keep these records for several years in case of any future inquiries.

Frequently Asked Questions About Dissolving an LLC

1. What Is the Difference Between Dissolving and Terminating an LLC?

Dissolving involves closing the LLC and settling its affairs while terminating is the final step in which the LLC ceases to exist legally.

2. How Do You Close an LLC?

Closing an LLC involves member agreement, filing Articles of Dissolution, winding up affairs, settling debts, and distributing assets.

3. Do I Need to Notify the IRS if I Close My Business?

Yes, you must notify the IRS by filing your final tax returns and indicating that they are the final returns.

4. How Much Does It Cost to Dissolve an LLC?

The cost varies by state but typically ranges from $20 to $200 in filing fees, plus any additional legal or accounting costs.

Conclusion: Properly Dissolving an LLC

Dissolving an LLC involves several important steps to ensure compliance with state laws and avoid future liabilities. By understanding the process, including filing requirements, costs, and IRS notifications, you can effectively dissolve your LLC and confidently move forward. Always consult with legal and financial professionals to ensure you handle all aspects of the dissolution correctly.

Key Takeaways

Key Takeaways

- The necessary steps, costs involved, and legal requirements if you’re ready to close your company.

- The differences between dissolving and terminating an LLC.

- The steps required to dissolve your business–from internal agreement and decision-making to winding up the LLC.

- Do you need to notify the IRS if you close your business?

- The costs associated with closing your LLC.

- Additional considerations for closing your LLC, like canceling licenses and permits, notifying creditors and stakeholders, and record-keeping requirements.

- Frequently asked questions about dissolving your LLC.

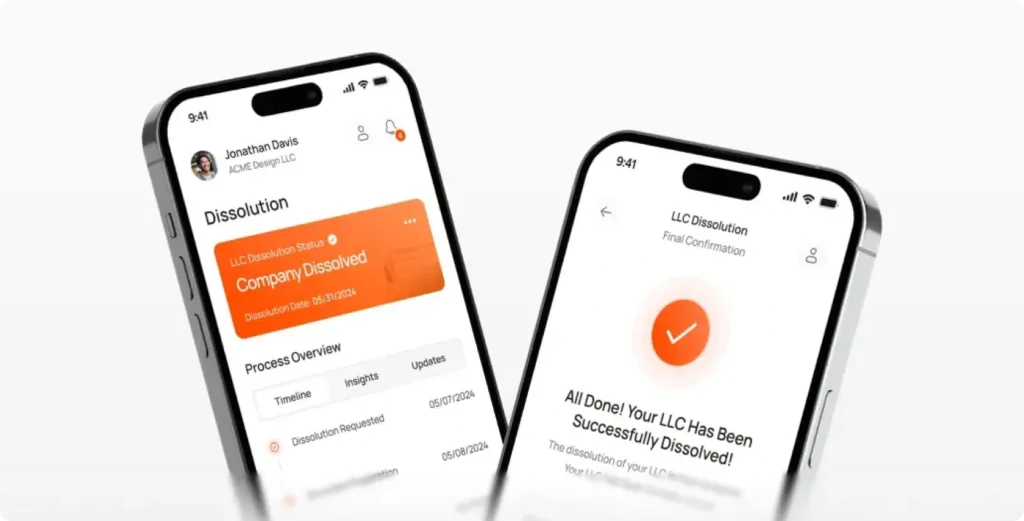

Simplify Your Business Exit

Hassle-Free Dissolution With Sunbiz

Closing your business is simple withSunbiz. Let us handle the details for you